Your nearly free path to a Luxurious Hawaiian Getaway: A Comprehensive Guide

Hyatt Regency in Maui

Hawaii, with its pristine beaches, lush landscapes, and welcoming aloha spirit, is a dream destination for many. However, the cost of flights, accommodations, and activities in this paradise can be daunting. Fear not, as the world of credit card points and miles offers a gateway to experiencing the wonders of Hawaii without draining your bank account… if you have the right cards. This guide will walk you through leveraging points, miles, and strategic credit card usage, particularly focusing on Transferrable Credit Cards, to significantly reduce your travel expenses.

Note: If done right, you should be able to book a Hyatt getaway for you and your travel partner (and kids too even) in less than 12 months (depending on availability of course). Strategies like this take patience, but you can absolutely have the trip of a lifetime!

But first: the Basics of Points & Miles Travel

Points and miles travel, sometimes referred to as travel hacking, refers to the art of using credit card rewards, airline miles, hotel points, and other loyalty program benefits to minimize travel costs. It's a legal and savvy way to turn your everyday spending into free or nearly free travel experiences. The core aspects include:

Earning Points and Miles: Through strategic credit card use, sign up bonuses, and participating in loyalty programs, you accumulate points or miles.

Redeeming Rewards: Using your accumulated points or miles to book flights, hotels, and other travel-related expenses.

Leveraging Transfer Partners: Transferring points between programs to maximize their value.

Step 1: Setting the Foundation with the Right Credit Card

(Click each card link to learn more, see current bonuses, an in depth breakdown and recommendation)

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred Card is a powerhouse for travel enthusiasts, offering lucrative sign-up bonuses, flexible reward points (Chase Ultimate Rewards), and a vast array of travel partners. Here's why it stands out:

Sign-Up Bonus: Often, the card offers a hefty bonus of Ultimate Rewards points after you spend a certain amount within the first few months.

Earning Potential: Earn multiple points per dollar spent on travel and dining, and one point per dollar on other purchases.

Transferability: Points can be transferred to numerous airline and hotel partners, often at a 1:1 ratio.

This top-rated card is your ultimate companion for all travel needs, Hawaii trips included. With Ultimate Rewards points, there are numerous ways to book your Hawaiian getaway.

Chase's preferred airline partners, United and Southwest, offer direct routes to Hawaii, and you might even snag a first-class seat on United.

Imagine flying roundtrip from Los Angeles to Honolulu with just 20,000 points per person by transferring your Chase points to United!

Plus, your card's points can cover your stay at luxurious hotels like Hyatt or Marriott. Using our points for stays at premium locations, such as the Andaz Maui at Wailea Resort can really make for an amazing experience

Capital One Venture X Rewards Credit Card

This is a card not often discussed, but you definitely don’t want to sleep on it. Here’s why:

The Capital One Venture X Rewards Credit Card offers significant travel benefits including a generous welcome bonus, high earning rates on purchases, and a substantial annual travel credit, enhancing your travel hacking opportunities.

Cardholders enjoy extensive flexibility in mile redemption, access to numerous transfer partners, and premium travel perks like airport lounge access, all contributing to maximizing travel rewards.

Essential travel protections and no foreign transaction fees, along with bonuses like Global Entry/TSA PreCheck credits and cell phone protection, provide comprehensive support and added value for travelers.

You’ll also receive a $300 annual travel credit (renews on your card anniversary) for travel purchases made via the Capital One Travel Portal.

Citi Premier® Card

Here's a stellar example of a card that can get you to Hawaii at no cost. Although its transfer partners are not as mainstream as those of Chase and Capital One, they offer some of the most favorable redemption rates for travel. Here are a couple other benefits:

The Citi Premier® Card offers valuable travel rewards, featuring a substantial points bonus for new cardholders, triple points on travel, dining, and supermarket purchases, and a generous annual hotel savings benefit.

The card includes no foreign transaction fees and provides an array of travel and purchase protections, ensuring that travelers get both convenience and security while managing expenses and navigating their journeys.

A prime strategy for utilizing your Citi ThankYou® Points for a Hawaiian getaway is to transfer them to Avianca LifeMiles (a Star Alliance member) and secure one-way award flights to Hawaii on United Airlines, starting at around 30,000 miles per person.

Honorable Mention: Hyatt Cards

Because we’ll be focusing primarily on a Hyatt hotel strategy for our stay in Hawaii, it doesn’t help to have some bonus points (and perks) thrown in from Hyatt Cards. That’s a good thing too, as Hawaii is FULL of Hyatt hotels (but we’re going to focus on the fancier ones). Click the links below to learn more and read about the bonus perks you’ll receive with each card.

The World of Hyatt Credit Card

World of Hyatt Business Credit Card

Step 2: Earning Points Strategically

Now that you’ve picked the card(s) that you want to work with, you’ve got to earn the points!

Maximizing Sign-Up Bonuses

The quickest way to accumulate a large number of points is through sign-up bonuses. Meeting the minimum spending requirement responsibly is key. Plan your application around big upcoming expenses to ensure you can hit the target without unnecessary spending.

Everyday Spending

Use your card for all your daily expenses to steadily accumulate points. Paying for dining, travel, and even monthly bills can significantly boost your points balance over time.

Bonus Categories

Take advantage of the card's bonus categories. For instance, if you earn double points on travel and triple points on online groceries and dining out like you do with the Chase Sapphire Preferred® Card, prioritize using your Chase card for these expenses.

Step 3: Plan your points “budget”

Depending on where you want to stay, where you’re coming from, and how many people are with you will depend on how many points you’ll need to execute this strategy. With this guide, our goal is to show you one of the many methods you can use to get to Hawaii on points, although there’s plenty of other ways to do it, and plenty of other places to stay.

Focus on Hyatt

Hyatt is known to give you the most bang for your points “buck” of all hotel chains, and let me show you what we mean.

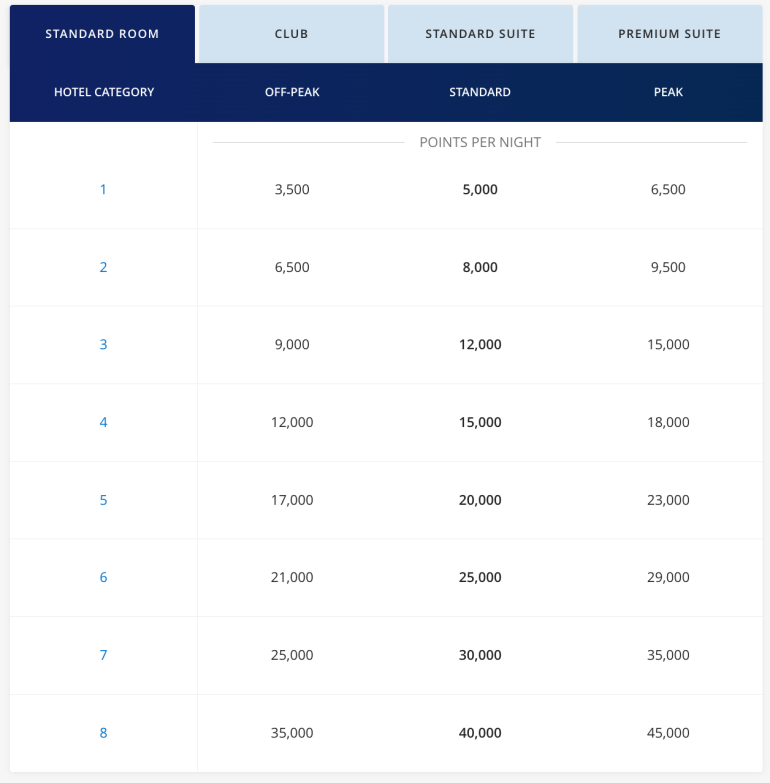

Hyatt point chart (courtesy of Nerdwallet)

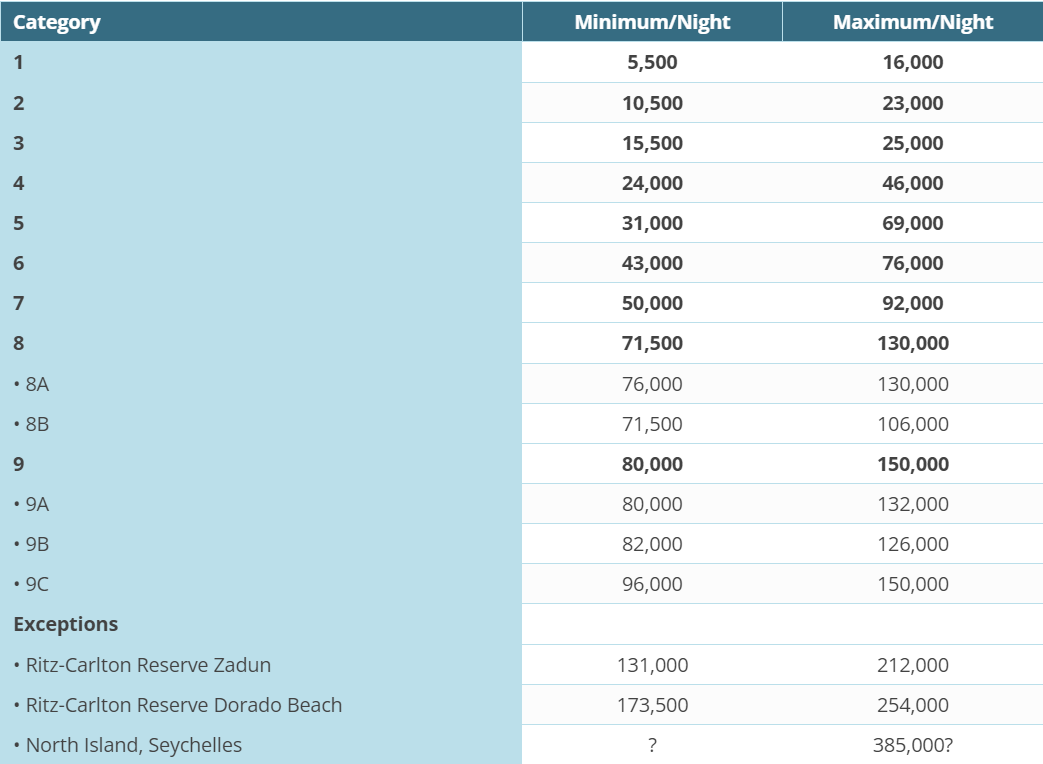

Now compare that with Marriott, which is 2x -3x more points per night needed for their higher tier hotels

Marriott Chart (courtesy of Frequent Miler)

Now although we are going to focus on Hyatt points, if you have a lot of Marriott or Hilton points already built up, or you have cards such as the American Express® Gold Card, or The Platinum Card® from American Express and you have amassed a lot of Amex points, then by all means use them for one of their properties!

Points needed for your stay

Here are the 3 places we’re going to recommend you plan to stay:

Hyatt Regency Maui Resort and Spa (Category 7)

Grand Hyatt Kauai Resort & Spa (Category 7)

Andaz Maui at Wailea Resort (Category 8)

The Category 7’s will run you 35k points per night normally, or 25k points if you can catch them at an off-peak time (early September and early December are good for off-peak) and the Category 8 will run you 45k points unless you catch the off peak bookings at 35k.

Obviously the number of nights you stay are going to dictate how many nights you need, but for this guide we’re going to plan on a 4 night stay.

So we know we’re going to need 100,000 - 180,000 points for this adventure.

Points needed for your flight

This is arguably the hardest thing to predict, as award flights change constantly. We’d recommend you use a points search engine like Roame or PointsYeah (which are both free) to help you with this, and even set alerts out there as well.

You can find economy flights transferring on United for 25k per person one way or Iberia for 31k per person one way. These are both transfers from Chase. If you have CapitalOne, then you can spend around 23k points to transfer to LifeMiles (Avianca). Honorable mention if you do have Amex points that you can also transfer those to LifeMiles, or you may even find a Delta ticket for 18k points. Return flights are around the same cost, although it’s not impossible to find some flights for as low as 10k points

(Note: Although this guide planning a nearly free Hawaii experience, we always recommend ONLY using points if you’re going to get 2c of value per point. Make sure to use the calculator on our site to make sure you’re getting enough value for your points)

If you want to fly in style with business class, then expect to pay 80k or more points using Chase or Amex transfer partners. However it’s not impossible to find 50k points. If you happen to have American Airlines miles, that may be one of your better bets depending on where you’re flying from.

For simplicity sake, lets assume that points are around 25k per person each way, so for a couple you’re looking at needed 100,000 points

Step 4: How to earn 200,000 points

This is arguably much better if you employ “Two Player Mode” which is where you have a travel partner embracing the points and miles lifestyle with you. So here’s how we’d do it if we were single, and here’s how we’d do it with a partner:

Single Player Mode:

1) Open up the Chase Sapphire Preferred® Card, and over the next 3 months spend $4,000 to earn the 60,000 points (at the time of this writing). Instead of using debit, use this card for everything, especially dining out as that earns 3x the points. If you have any travel plans, you get 5x points on travel (rental cars, hotels, etc) that you book through the chase portal.

Just by spending that $4,000 you’re going to get a minimum of 4,000 points as well, if not more by using the points multipliers.

2) After you’ve hit your SUB (Sign Up Bonus) on the Chase Sapphire Preferred® Card, and also after waiting 60-90 days, apply for the The World of Hyatt Credit Card. This card will earn you 35,000 by just spending $3k in the first 3 months, and similar to the other cards, you’ll earn a minimum of 3,000 points on that $3k.

Collectively you should now have close to 100,000 points (if not a lot more) built up in a 6 month period from these two cards

3) Start searching for 8-12 months out for Hyatt availability. You can do this by logging into your World of Hyatt account, searching for the property you want to stay at, picking random dates. Make sure to check the box “Use Points”

Note: it doesn’t really matter if you don’t know the days you actually want to stay, you can always see the points calendar by going through the booking process

This will lead you to the points calendar, which will show you pricing per night for your stay, and you can look up to about 1 year out.

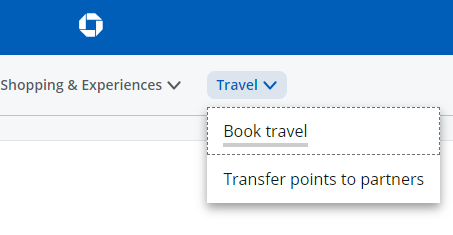

4) Transfer Chase points to Hyatt

Log in to your Chase account and click on the rewards you want to use.

Find the Ultimate Rewards section, go to the Travel dropdown and select Transfer to Travel Partners

3. Select Hyatt, input the points you need (to combine with your existing Hyatt points) and hit “Transfer Points”

Note: Transfer times say they can take up to a couple days, but we’ve never had a transfer that wasn’t instant.

5) Go ahead and book the days you want to stay. Don’t worry about the flights yet, we’re about to cover that. The good news with Hyatt, is you can get a full refund of your points if you have to cancel typically outside of 24 -72 hours before your check-in date.

Now it’s time to focus on points for the flights, knowing that the trip is 8+ months out

6) Open the Capital One Venture X Rewards Credit Card and get its 75,000 points when you spend $4k in the first 3 months. Because it earns a minimum of 2x points on all purchases, if you can spend $12,500 in the first 3-6 months then you’ll have 25,000 points + your 75,000 SUB = 100,000 points.

If that’s more than you typically spend in a 6 month period, you can optionally opt to get the Citi Premier® Card 3 months after you’ve applied for the Venture X card.

7) Find the flight using Roame or PointsYeah to see what is available.

Then BEFORE transfering any points, make sure to go to that airline’s site and see if what you found is actually available. You will likely need to create a free rewards account if you don’t already have one to view availabliity.

8) Once you have enough points, book the flight!

To transfer points with Capital One, it’s a similar process with Chase, except you go to the “convert rewards” section

2 Player Mode

1) Partner A Opens up the Chase Sapphire Preferred® Card, and over the next 3 months spend $4,000 to earn the 60,000 points (at the time of this writing). Instead of using debit, use this card for everything, especially dining out as that earns 3x the points. If you have any travel plans, you get 5x points on travel (rental cars, hotels, etc) that you book through the chase portal.

Just by spending that $4,000 you’re going to get a minimum of 4,000 points as well, if not more by using the points multipliers.

Do not add each other as authorized users to the card

Partner A sends their unique referral code to Partner B, and that gets them between 10,000 - 20,000 points additionally

If partner A and B live together and don’t have enough separate expenses for one person to do this on their own, then group all expenses together. After you hit the SUB for Partner A, then Partner B can apply for the same card.

If You don’t live together or you have enough expenses to support both partners doing this at the same time, then both can separately apply for the card at the same time, or even better, one can apply for the Chase Sapphire Reserve® and really enhance your travel experiences.

2) See steps 3-5 of Single Player Mode (above)

Note: You can have separate Hyatt bookings (so Partner A covers nights 1-2 and Partner B covers nights 3-4) and message Hyatt/The Property and have them combine the bookings, OR you can contact Hyatt and transfer points from one Hyatt Member to another

3) See steps 6-8 of Single Player Mode (above)

You likely will be able to hit the $12,500 target spend pretty easily in 3-6 months between two people, however Partner B can look into getting the Citi Premier® Card to build up additional transferrable points.

Step 5: Do the math

These same flights for 20k - 25k points are around $850 round trip per person.

The same rooms that are 25k points per night (off peak) are $624/night

Total Flight Cost: $1700 Round Trip for 2 people

Total Hotel Cost: $2,496 for 4 nights

Total Cash Cost: $4,196

What you paid:

Flight taxes when using points: about $15 per person each way = $60

Credit Card Fees:

Chase Sapphire Preferred® Card - $95 (x2 for 2 player mode)

Capital One Venture X Rewards Credit Card - $395 (However you get $300 annual credit for bookings through Capital One Travel)

Assuming you use that benefit, as well as the $100 to pay for TSA PreCheck or Global Entry for 5 years for yourself or anyone you choose, this card is essentially free

(For Single Players) The World of Hyatt Credit Card - $95

Effective cost - $190 + $60 flight taxes = $250

However you analyze it, you’ve paid a couple hundred bucks to get $4,000+ in benefit. And this is just the start.

It’s worth noting:

This is just the basics. In our basic overview podcast episode we mentioned the bare minimum use of points should get you 2c per point of value. That means using 200,000 points should get you minimum $4,000 of value. This breakdown here just barely hits that mark.

Realistically if I was going to spend 200k points I would want to get $8,000 - $20,000+ of travel value, and that usually would come with business class flights, but that takes a lot more time and research to be able to find.

There are many things that could be done to elevate your experience with more time and experience. For instance if you worked on obtaining Hyatt Globalist status, then this same stay would come with likely a room upgrade, or you could even apply a suite upgrade, as well as have free breakfast for you and your family each day.

Conclusion

By mastering the art of points and miles, particularly with the right cards, your dream Hawaiian vacation can become a reality without the hefty price tag.

Remember, be strategic with your spending, and plan ahead. So, start your journey today, and soon you'll be sipping a Mai Tai on a stunning Hawaiian beach, reveling in the satisfaction of a luxury vacation achieved for pretty close to free!