Traveling for free may sound like a dream, but it’s entirely possible with the right strategies. Leveraging credit card points, frequent flyer miles, and other rewards programs, you can turn everyday expenses into free flights, hotel stays, and even full vacations.

HAVE YOU EVER…

…taken that international flight, walked through first or business class, and wondered, “if only?” Often times these seats that allow you to lay flat and sleep on a long haul flight cost $5,000 – $25,000 PER TICKET. But YOU TOO can be amongst those traveling in luxury with understanding the points and miles game.

This is all about the the art of using credit card sign-up bonuses, rewards programs, and other strategies to earn free or discounted travel. It can sometimes feel overwhelming, but it can also be a extremely rewarding.

There are a few different ways to expedite award travel with points and miles. One common method is to sign up for credit cards that offer sign-up bonuses. These bonuses can be in the form of points, miles, or cash back, and they can be worth hundreds or even thousands of dollars. Once you’ve earned a sign-up bonus, you can use those points or miles to book free flights, hotels, or other travel expenses.

Here’s what you need to know

If you’d rather listen to an overview, here’s one of our early podcast episodes

Table of Contents for this Guide

Understanding Travel Rewards Programs

Maximize Credit Card Welcome Offers

How to Meet Credit Card Minimum Spend Without Overspending

Choose Your Approach – Flexible Points vs Destination-Based Strategy

Won’t this affect my Credit Score?

Many credit cards offer substantial bonuses, such as earning 60,000 points after spending $4,000 within three months. These points can equate to $600 at a bare minimum or ideally more in travel value, depending on how you redeem your points. By meeting this requirement, you earn points that can be redeemed for flights or hotel stays, enabling nearly free vacations.

Now this is great, however there are two things we immediately want to make clear:

- You don’t spend above your means for these points

- You don’t go into debt by not paying off 100% of what you spent

More on these points later, but we want to make that clear from the beginning, as financial responsibility is always at the forefront of what we teach.

Understanding Travel Rewards Programs

Travel rewards programs come in various forms:

- Credit Card Rewards: Earn points or miles for spending on travel, dining, groceries, and more.

- Frequent Flyer Programs: Airline loyalty programs that allow you to earn miles with specific carriers or alliances.

- Hotel Loyalty Programs: Earn points for stays, redeemable for free nights or upgrades.

The key to success is understanding the value of each program and focusing on those that align with your travel goals.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Credit Card Rewards Programs

Credit card rewards programs are among the easiest and fastest ways to earn points for free travel. These programs reward you for everyday spending and often include lucrative sign-up bonuses. There are three main types of credit card rewards programs:

- Bank-Specific Rewards:

- Programs like Chase Ultimate Rewards, American Express Membership Rewards, and Citi ThankYou Points allow you to earn points through spending and sign-up bonuses.

- Points can often be redeemed for travel directly through the bank’s portal or transferred to partner programs for potentially greater value.

- Example: Chase Ultimate Rewards points transfer to partners like Hyatt, United Airlines, or Southwest Airlines.

- Co-Branded Credit Cards:

- These cards are tied to a specific airline or hotel chain (e.g., Delta SkyMiles® American Express Card or Marriott Bonvoy Boundless® Credit Card).

- Benefits include faster point accumulation within the brand, elite status perks, and free night awards or companion tickets.

- Example: The Hilton Honors American Express Surpass® Card offers a free weekend night reward after meeting spending requirements.

- Cash-Back Credit Cards:

- Though not directly travel-focused, some cash-back cards allow you to convert cash back into travel credits or transfer it to airline and hotel programs.

Pro Tip: Focus on flexible point programs like Chase Ultimate Rewards and AmEx Membership Rewards when starting, as they offer more versatility in redemption.

Frequent Flyer Programs

Frequent flyer programs are loyalty programs offered by airlines, rewarding travelers with miles for flights and spending with partnered companies. Here’s what you need to know:

- Major Airline Alliances:

- Many airlines belong to alliances (e.g., Star Alliance, Oneworld, SkyTeam), allowing you to earn and redeem miles across multiple carriers.

- Example: Earning United MileagePlus miles can also be used for flights on Lufthansa or ANA.

- Award Flights:

- Redeem miles for free or discounted flights. The number of miles required depends on the route, travel class, and award availability.

- Example: A domestic round-trip flight may cost 25,000 miles, while a business-class flight to Europe might cost 70,000 miles.

- Elite Status:

- Frequent flyer programs often offer elite tiers (e.g., Silver, Gold, Platinum), providing perks like free checked bags, priority boarding, and lounge access.

- Example: American Airlines AAdvantage offers complimentary upgrades and bonus miles for elite members.

Pro Tip: Sign up for frequent flyer programs even if you fly infrequently. Miles can be earned through credit card transfers, dining programs, and shopping portals, not just flights.

Hotel loyalty programs allow you to earn points for stays, which can be redeemed for free nights, room upgrades, and other perks. Key features include:

- Major Hotel Programs:

- Popular programs include Marriott Bonvoy, World of Hyatt, Hilton Honors, and IHG One Rewards.

- These programs often align with co-branded credit cards, offering bonus points, automatic elite status, and free night awards.

- Redemption Opportunities:

- Points can be redeemed for free nights, often with no blackout dates (depending on the program).

- Example: Hyatt’s award chart starts at 5,000 points for a Category 1 hotel, making it an excellent value for free stays.

- Elite Status:

- Similar to airlines, hotel programs offer elite tiers (e.g., Gold, Platinum, Diamond), providing benefits like free breakfast, late check-out, and suite upgrades.

- Example: Hilton Honors Gold Status offers complimentary breakfast and room upgrades, which can be obtained through the Hilton Surpass Card.

Pro Tip: Use points for high-value redemptions like luxury hotels or peak travel dates when cash rates are high.

Maximize Credit Card Welcome Offers

Credit card welcome offers are one of the fastest and most effective ways to accumulate points and miles for free or discounted travel. These offers provide a large chunk of points as a “welcome gift” when you meet a specific spending requirement within the first few months of opening a new card. Here’s why they’re so important and how to maximize them:

What Are Welcome Offers?

Think of a credit card welcome offer as an introductory bonus—a reward for becoming a new customer. When you meet the spending requirement (known as the “minimum spend”), you earn a large number of points or miles, often worth hundreds or even thousands of dollars in travel.

For example:

- A card may offer 60,000 points after spending $4,000 in the first 3 months.

- These points could be worth $750 or more, depending on how you redeem them.

Why Are Welcome Offers Important?

Earning points through everyday spending alone (like 1-2 points per dollar spent) can take months or even years to accumulate enough for a significant reward. Welcome offers, on the other hand, provide an instant boost that can often cover an entire flight or several hotel nights. It’s the quickest way to jumpstart your rewards journey.

Why It’s So Effective

Let’s break it down:

- Say a round-trip domestic economy flight costs 25,000 miles.

- A welcome offer of 60,000 points could cover more than two round-trip flights—or be used for an international trip in business class.

Instead of earning points slowly over time, a welcome offer gets you travel-ready much faster.

How to Meet Credit Card Minimum Spend Without Overspending

Meeting a credit card’s minimum spend to earn a welcome bonus is essential for maximizing your points and miles, but it doesn’t mean you should overspend or take on unnecessary debt. Here’s a detailed breakdown of strategies to meet those requirements efficiently and responsibly:

Redirect your regular expenses to your new credit card instead of paying with cash, debit, or another card. Examples include:

- Groceries and Dining: Pay for your weekly grocery trips and restaurant meals with the card.

- Gas and Transportation: Use it for fuel, public transportation, or ride-shares like Uber and Lyft.

- Recurring Bills: Many monthly bills can be paid with a credit card, including:

- Internet, phone, and cable services.

- Subscription services like Netflix, Spotify, or Amazon Prime.

- Insurance Payments: Check if your auto, home, or renter’s insurance provider accepts credit card payments.

Pro Tip: If you’re used to paying with cash or debit, deposit the same amount into your bank account after charging the expense to avoid debt.

Timing is key. If you have significant expenses coming up, use your credit card to cover them. Common examples:

- Holiday Shopping: Buy gifts during holiday sales.

- Home Improvements: Purchase furniture, appliances, or materials for renovations.

- Travel Costs: Pay for flights, accommodations, or car rentals for an upcoming trip.

- Medical or Dental Bills: Some providers allow credit card payments for larger bills.

- Education Expenses: If you’re paying tuition or school fees, use your card where possible.

Many expenses that usually require checks or direct bank transfers can be paid with a credit card using third-party services:

- Plastiq: This platform allows you to pay rent, mortgages, HOA fees, or even taxes using your credit card. They charge a small fee, but the value of the points or miles often outweighs the cost if you’re earning a large welcome bonus.

- Utility Companies: Some providers accept credit card payments, so check with your local service.

If you know you’ll be shopping at certain stores or dining at specific restaurants in the future, purchase gift cards to lock in spending now. Examples include:

- Grocery stores

- Gas stations

- Amazon or big-box retailers (e.g., Target, Walmart)

- Restaurants or coffee shops

Pro Tip: Stick to stores you frequently shop at to ensure the cards won’t go unused.

Note: This can easily be abused, and if you are found to be buying too many gift cards, especially to earn sign up bonuses, many card companies will close your account, not issue points, etc.

If you’re sharing expenses with others, offer to pay with your credit card and have them reimburse you. Examples:

- Dining Out: Pick up the tab for group meals and collect cash or Venmo payments from friends.

- Trips: Pay for hotels, flights, or car rentals for group vacations, then have others reimburse you.

- Household Costs: Cover shared utilities, groceries, or subscriptions with roommates.

Some companies allow you to pay ahead for services you’ll use in the future, including:

- Utilities: Prepay for electricity, water, or gas.

- Insurance: Pay your premiums annually instead of monthly.

- Subscriptions: Purchase an annual membership instead of paying monthly (e.g., Amazon Prime, Spotify, Disney+).

If you trust a spouse, family member, or close friend, you can add them as an authorized user. Their spending will also count toward meeting the minimum spend. Make sure they’re responsible with money, as you’ll ultimately be liable for the charges.

Many credit cards offer shopping portals that let you earn extra points while meeting your spending requirement. Combine this with regular purchases:

- Rakuten (connects with AmEx Membership Rewards)

- Airline shopping portals like American Airlines AAdvantage Shopping or United MileagePlus Shopping

If you run a business or side hustle, use your personal card for business-related purchases (ensure you keep track for accounting purposes):

- Inventory or supplies

- Advertising costs (e.g., Facebook, Google Ads)

- Shipping costs for products

- If you have payroll, you can quickly hit your minimum spend and earn a massive amount of points

Pro Tip: If you qualify, business credit cards often come with higher welcome bonuses and additional perks.

Choose Your Approach

Flexible Points (Most Recommended)

The flexible point strategy focuses on earning points that can be transferred or redeemed with multiple travel partners, offering unmatched versatility and value. This approach allows you to adapt your rewards to your travel needs, making it ideal for beginners or anyone looking for maximum flexibility.

This is also helpful if you don’t have a set trip or destination in mind. If you know you want to experience nearly free travel, and especially in luxury, this is where you want to start.

Here’s our list of best flexible cards for rewards points

Here’s an in-depth look at how it works and why it’s such a powerful strategy.

Destination-Based Strategy

This strategy starts by identifying your travel goals—where you want to go, how you want to get there, and where you plan to stay. Once you have a destination or trip in mind, you choose credit cards that earn points or miles most useful for that trip.

For example:

- Want to fly to Japan? Focus on cards that earn miles with airlines flying to Asia, like ANA, United, or American Airlines.

- Planning a tropical beach getaway? Look for hotel credit cards like Hilton Honors, Marriott Bonvoy, or World of Hyatt that have properties in your destination.

By focusing your efforts, you avoid spreading your rewards thin across programs that may not meet your specific needs.

While the destination-based strategy can be powerful for seasoned travelers with specific goals, it’s often less practical for beginners who are just starting to explore points and miles. Here’s why it’s not the best choice for novices compared to using flexible point cards:

1. What Are Flexible Points?

Flexible points are rewards earned through credit cards that can be redeemed in various ways, including:

- Transferring to multiple airline and hotel loyalty programs.

- Booking travel directly through the card issuer’s portal.

- Using points for other purchases, like cashback, statement credits, or gift cards (though travel redemptions often provide the best value).

Examples of flexible point programs:

- Chase Ultimate Rewards (e.g., Chase Sapphire Preferred®, Chase Sapphire Reserve®)

- American Express Membership Rewards (e.g., AmEx Gold Card, AmEx Platinum®)

- Citi ThankYou Points (e.g., Citi Premier®)

- Capital One Miles (e.g., Capital One Venture®)

2. Why the Flexible Point Strategy Works for Beginners

2.1 Adaptability to Changing Travel Goals

- Beginners often don’t have fixed travel plans. Flexible points allow you to decide how and where to redeem once you’ve finalized your destination.

- You’re not locked into a single airline or hotel program, making it easy to adjust based on availability or value.

Example: If you’re planning a trip to Europe but haven’t chosen your airline or hotel, flexible points can be transferred to partners like United (for flights) or Hyatt (for hotels), depending on your needs.

2.2 Maximize Redemption Value

Flexible points give you the ability to “shop around” for the best redemption rates:

- Transfer Partners: By transferring points to airline and hotel loyalty programs, you can often unlock outsized value (e.g., first-class flights or luxury hotels).

- Travel Portals: If transferring isn’t your preference, most programs have travel portals where you can redeem points for flights, hotels, car rentals, and more—often with no blackout dates.

Example:

- 50,000 Chase Ultimate Rewards points can be worth $750 in travel through the Chase portal (1.5x value with Sapphire Reserve) or transferred to partners like Singapore Airlines for a first-class experience.

2.3 Earn More Points from Everyday Spending

Flexible point cards offer bonus categories for everyday purchases, helping you earn points faster. Common categories include:

- Dining: 2x–4x points at restaurants.

- Groceries: Up to 4x points on grocery store purchases.

- Travel: 2x–5x points on flights, hotels, and transportation.

Example:

- The AmEx Gold Card offers 4x points on groceries and dining, making it easy to accumulate points without changing your spending habits.

- The Chase Sapphire Preferred® offers 2x points on all travel and dining purchases.

2.4 Access to Broad Travel Perks

Flexible point cards often come with perks that enhance your travel experience, such as:

- Travel insurance and trip protection.

- No foreign transaction fees.

- Credits for TSA PreCheck or Global Entry.

- Lounge access (with premium cards like AmEx Platinum® or Chase Sapphire Reserve®).

3. How to Implement the Flexible Point Strategy

Step 1: Choose the Right Card

Pick a flexible point card with strong earning potential and valuable redemption options. For beginners, these cards are excellent choices:

- Chase Sapphire Preferred®: Earn 60,000 points after spending $4,000 in 3 months; points transfer to airlines like United and hotels like Hyatt.

- AmEx Gold Card: Earn 60,000 points after spending $4,000 in 6 months; 4x points on dining and groceries.

- Citi Premier®: Earn 60,000 ThankYou points after spending $4,000 in 3 months; 3x points on dining, groceries, and travel.

Step 2: Focus on Earning Points Through Everyday Spending

Maximize your rewards by putting all eligible purchases on your card, especially in bonus categories like:

- Groceries and dining.

- Travel expenses (flights, hotels, car rentals, etc.).

- Online subscriptions and streaming services.

Tip: Use your card for large planned expenses, like holiday shopping or home improvements, to quickly meet the minimum spend for the welcome bonus.

Step 3: Learn About Transfer Partners

Understand which airlines and hotels your points can transfer to for the best value. For example:

- Chase Ultimate Rewards: Partners include United Airlines, British Airways, Southwest Airlines, and Hyatt.

- AmEx Membership Rewards: Partners include Delta, ANA, Singapore Airlines, and Hilton.

- Citi ThankYou Points: Partners include Turkish Airlines, Avianca, and Wyndham Hotels.

Example: Transfer 25,000 points to Turkish Airlines for a round-trip domestic flight in business class (versus paying 50,000 points with some U.S. airlines).

Step 4: Redeem Points Strategically

- For Flights: Transfer points to airline programs to book award flights at a lower cost. Look for sweet spots, like business-class flights to Europe for fewer points than economy on other airlines.

- For Hotels: Transfer points to hotel programs for free nights, upgrades, or luxury stays.

- Through Portals: Use travel portals for straightforward bookings with no blackout dates.

4. Advantages of the Flexible Point Strategy

- Versatility: Use points for flights, hotels, car rentals, and more across multiple programs.

- High Value: Maximize points through transfers or travel portals for premium redemptions.

- Ease of Use: Redeem points for nearly any type of travel, making it beginner-friendly.

- Earning Potential: Bonus categories and welcome offers provide a steady stream of points.

5. Who Should Use This Strategy?

The flexible point strategy is perfect for:

- Beginners who are unsure of their travel plans.

- Travelers who value freedom and versatility.

- Anyone looking to maximize rewards without committing to a single airline or hotel program.

1. Limited Redemption Options

- Destination-based cards (e.g., co-branded airline or hotel cards) typically earn points or miles tied to one specific brand, such as Delta SkyMiles or Marriott Bonvoy points.

- If your travel plans change or your chosen brand has no availability, you’re stuck with points that may not be usable for your new destination.

- Flexible point cards let you transfer points to multiple airlines and hotel partners, offering far more versatility.

Example: With Chase Ultimate Rewards, you can transfer points to Hyatt, United, British Airways, and more, making it easy to adapt your plans.

2. Beginners May Not Know Their Travel Goals

- Many beginners don’t have specific destinations or travel plans in mind when starting out.

- A flexible point card allows you to earn points without committing to a single airline or hotel, giving you time to figure out your preferences.

Example: If you start with a Delta SkyMiles card but later realize you prefer United’s routes or prices, you won’t be able to use your Delta miles for those flights.

3. Fewer Bonus Categories for Everyday Spending

- Co-branded cards often have limited bonus categories for earning points. For instance:

- An airline card may only earn extra miles on flights with that airline.

- A hotel card may only earn bonus points on stays at that hotel chain.

- Flexible cards, on the other hand, offer bonus points on common spending categories like dining, groceries, and travel, helping beginners rack up points faster.

Example: The AmEx Gold Card offers 4x points on dining and groceries, while a co-branded hotel card may only earn 2x points on general spending.

4. Lower Welcome Bonuses for Co-Branded Cards

- Flexible cards often come with higher-value welcome bonuses and better transfer ratios.

- For example:

- Chase Sapphire Preferred: 60,000 points, transferable to dozens of travel partners.

- Delta SkyMiles Card: A similar bonus (e.g., 50,000 miles) but locked into Delta’s program.

5. Lack of Flexibility for Maximizing Value

- Flexible points programs let you redeem for the best value:

- Book flights directly with points.

- Transfer to airline or hotel partners for premium redemptions.

- Use travel portals to book without worrying about blackout dates.

- Co-branded cards often have restrictions, such as limited award availability or variable pricing.

Example: With Hyatt points, you can book a luxury suite at a fixed rate (e.g., 25,000 points), while Hilton points for the same suite may cost significantly more during peak times.

6. Missing Out on Broad Travel Perks

- Flexible point cards often come with additional travel benefits, such as:

- Travel insurance

- Trip cancellation protection

- Credits for travel purchases (e.g., TSA PreCheck, Global Entry)

- Many co-branded cards only offer perks specific to their brand, like free checked bags or priority boarding.

Why Flexible Point Cards Are Better for Beginners

- Versatility: You can use points across multiple airlines, hotel chains, and travel partners.

- Ease of Use: No need to navigate specific loyalty programs or learn their intricacies right away.

- Faster Earning Potential: Higher bonuses on everyday spending categories.

- No Commitment: You can adjust your travel plans without worrying about wasting points.

When a card offers an increased “limited-time” offer, that can be your best opportunity

Limited-time increased welcome offers are some of the best opportunities to earn points and miles quickly. These bonuses often provide an incredible return on spending, with rewards far exceeding a card’s regular earning rates. For example, a 100,000-point bonus for $4,000 of spending equates to 25 points per dollar—helping you fast-track travel goals like business-class flights or luxury hotel stays at minimal cost.

These elevated offers are often the highest bonuses a card ever provides, but they don’t last long, making it crucial to act quickly. By timing your applications around these promotions, you can unlock expensive travel experiences at a fraction of the price. They’re also great for maximizing transfer opportunities to airline or hotel partners, enabling aspirational redemptions like first-class upgrades or round-the-world tickets.

To ensure you never miss these rare deals, subscribe to our newsletter and podcast! We’ll notify you as soon as these offers go live and provide expert insights on how to maximize them. Let us help you stay ahead of the game and make the most of your points and miles journey.

Now it’s Time to Address The Elephant in the Room

What About the Annual Fees?

If I asked you to give me $95 in return for $1,250, would you do it? What about $300 in exchange for $3,000 or even $695 in exchange for $5,000? Well in todays world you’d probably assume it was too good to be true, but in essence that’s how credit card fees work when:

- You don’t carry a balance and pay them off on time

- You redeem your points for travel value (not statement credits, amazon purchases, etc.)

Paying an annual fee for a credit card can be a smart choice if the benefits outweigh the cost. Many of these cards offer significant value through large welcome bonuses, which alone can far exceed the fee. They also provide perks like extra points for everyday spending, and valuable travel benefits like lounge access, free checked bags, or hotel upgrades. Additionally, these cards often include protections like travel insurance and purchase coverage, giving you peace of mind. When used wisely—especially for purchases you already make—the rewards and perks can save you money and enhance your travel experiences, making the annual fee well worth it.

Let's break down the numbers a bit

Welcome Bonuses

Many premium credit cards offer lucrative welcome bonuses that far outweigh the annual fee.

Example:

- A card with a $95 annual fee offers a 60,000-point welcome bonus after spending $3,000 in the first 3 months.

- If the points are worth 1.5 cents each (a common minimum valuation), the bonus is worth: 60,000×0.015=$900

- Subtract the $95 fee: $900−$95=$805 net benefit

Even without any other perks, the welcome bonus alone can justify the annual fee in the first year.

Ongoing Rewards and Multiplier Categories

Premium cards often earn higher points in key categories (e.g., 3x on travel or dining). Over the course of a year, this can far outweigh the annual fee.

Example:

- You spend $10,000 annually on dining and travel, earning 3x points on these categories.

- With a card that values points at 1.5 cents each: 10,000×3×0.015=$450 in rewards

- Subtract a $95 annual fee: $450−$95=$355 net benefit

Travel Perks and Benefits

Premium travel cards often come with perks such as lounge access, travel credits, TSA Precheck / Global Entry credits, hotel elite status, free checked bags and more

Example:

- Lounge access for a family of 4 costs $50 per person per visit without a card. You take 4 trips per year, using the lounge each time: 4×4×50=$800 saved

- You may say that you’d never visit a lounge, but keep in mind you typically have unlimited food and drink in the lounges

- How much does that save you over the course of the year vs paying for food at the airport?

- Many top tier cards that come with lounge access also have some sort of travel credits, such as $300 with the Chase Sapphire Reserve® and the Capital One Venture X Rewards Credit Card

- This effectively lowers the annual fee by the value of the travel credit

- You combine the $800 lounge value above, with the $300 travel credit, plus you use the card to get Global Entry ($120 value) but the card has a $395 annual fee

- $800+$300+$120 benefits – $395 fee = $825 net benefit

But what about after the first year?

Paying the fee in the first year absolutely makes sense when you are going to receive a SUB (Sign Up Bonus), however you have some decisions to make after that. You can choose to:

Option A

Keep the card and continue to pay the annual fee

Option B

Downgrade to a card with a lesser or no annual fee

Option C

Cancel the Card

Elevate Your Points & Miles Game with 2-Player Mode

In “2-player mode,” where two people coordinate their credit card strategies, keeping a card with an annual fee can be highly rewarding when paired with strategic sign-ups and referrals. By having both partners apply for the same card, each earns the welcome bonus, dramatically increasing the total points earned. For example, you sign up for a card and earn 70,000 points after meeting the minimum spend. As you near completion, you refer your spouse or partner to the same card, earning a referral bonus when they apply and are approved. They then meet their minimum spend and earn 70,000 points. This strategy transforms a single 70,000-point bonus into over 140,000 points plus the referral bonus, maximizing rewards and making the annual fee worthwhile through teamwork.

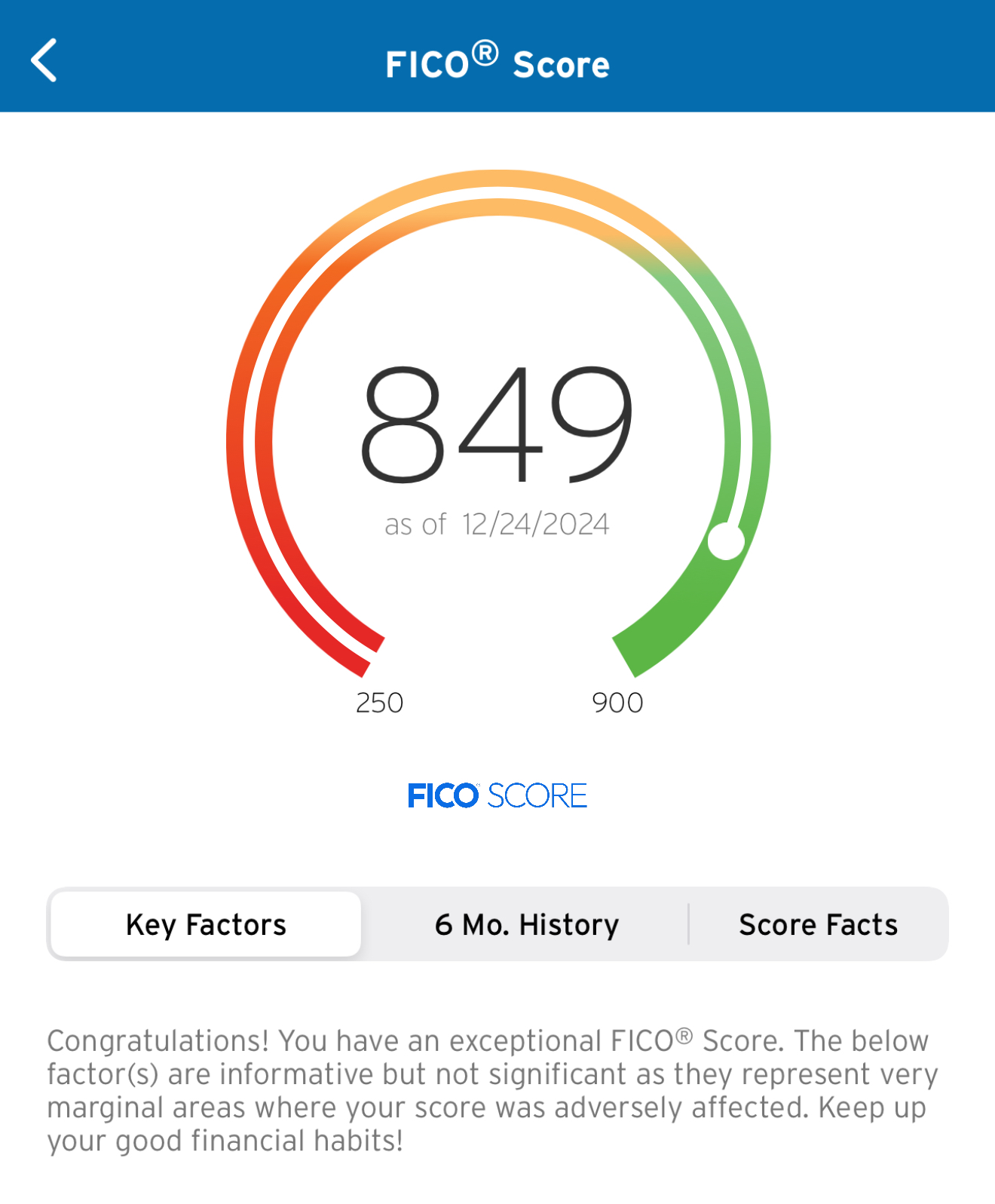

Won't this affect my Credit Score?

Using points and miles strategies responsibly won’t ruin your credit score; in fact, it can often improve it over time. When managed correctly, opening and using credit cards affects your credit score in several ways:

- Payment History (35%): Paying your bills on time is the most significant factor for your score. As long as you pay your balances in full and on time, your score remains strong.

- Credit Utilization (30%): Having multiple cards increases your total available credit, which can lower your credit utilization (the percentage of credit used compared to your limit). Keeping utilization low boosts your score.

- Length of Credit History (15%): Opening new cards may slightly reduce your average account age in the short term, but the impact is minor if you have older accounts that remain open.

- Credit Mix (10%): Having a mix of different credit types (e.g., cards, loans) can improve your score, and credit cards are part of that mix.

- New Credit (10%): Applying for cards creates a hard inquiry on your credit report, which might lower your score by a few points temporarily. However, the impact fades within a few months and is minor compared to the overall benefits.

When used wisely—paying balances in full, avoiding excessive applications, and keeping accounts open as long as they’re beneficial—your credit score can remain strong or even improve. Most people find that the benefits of points and miles far outweigh the small, short-term dips from credit inquiries.

Which Cards Do I Need To Get Started?

When starting your journey with credit cards for points and miles, it’s important to choose cards that align with your spending habits and travel goals.

For personal use, look for cards that offer flexible rewards and valuable perks. The best personal cards typically provide generous welcome bonuses, earn points on everyday spending categories like dining and travel, and offer benefits such as travel protections and the ability to transfer points to airline and hotel partners. These features help you maximize rewards and achieve your travel goals faster.

If you own a business or have a side hustle, business credit cards can be a powerful tool for earning rewards. These cards often feature large welcome bonuses and higher earning rates on business-related expenses, such as advertising, shipping, or office supplies. Using a business credit card not only accelerates your points-earning potential but also helps separate personal and business finances, and many business cards don’t report on your personal credit.

Is This Right for Me?

Is This Right for Me?

Using credit cards to earn points and miles for travel can be a great strategy if you have good credit, pay off your balances in full each month, and have specific travel goals in mind. If you’re disciplined with your spending and can manage multiple accounts responsibly, this approach allows you to unlock significant savings on flights, hotels, and other travel experiences. It’s also ideal for those who can meet the minimum spending requirements for welcome bonuses without overspending.

Who Is This Not Right For?

- This strategy may not be right for you if you carry credit card debt, as the interest charges will outweigh any rewards earned.

- It’s also not suitable if you have trouble sticking to a budget or if opening new credit cards might tempt you to overspend.

- Additionally, if your credit score is low, it’s better to focus on building credit first, as most rewards cards require good to excellent credit for approval.

- Finally, if you don’t travel often or don’t value premium travel perks, the effort and annual fees involved may not provide enough benefit to justify the strategy.

Don’t worry, it’s easier than you think

Traveling for free or nearly free might feel overwhelming at first, with so many points programs, credit card strategies, and travel hacks to navigate. The good news is that it’s much easier than you think once you take the first step and start learning the basics.

By making small, intentional changes—like leveraging shopping portals, using the right credit cards, or maximizing loyalty programs—you can unlock a world of opportunities without spending a fortune. What seems complicated now will soon become second nature, and you’ll be amazed at how quickly the rewards add up.

Whether you’re dreaming of luxury getaways, family adventures, or budget-friendly escapes, we’re here to guide you every step of the way. Follow us for all the tips, tools, and insider knowledge you need to simplify the process, avoid costly mistakes, and confidently turn your travel dreams into reality. The world is waiting, and we’re here to help you explore it—without breaking the bank!