CardPointers App Review: Time to Maximize Your Credit Card Rewards

Wish you could have a personal assistant in your pocket, telling you exactly which credit card to use for every purchase, stacking up the best deals and maximizing your rewards—all without memorizing categories or searching through dozens of offers? That’s exactly the problem CardPointers solves. In this detailed CardPointers app review, I’ll show how this app is changing the game for both beginners and points pros. CardPointers might be the single best credit card rewards app available to help you maximize Amex offers automatically, keep track of annual fees, or to simply make smarter decisions every time you swipe or tap your card.

Want to know some of our other favorite tools? See our full list here

What Is CardPointers? The App That Solves Points and Miles Headaches

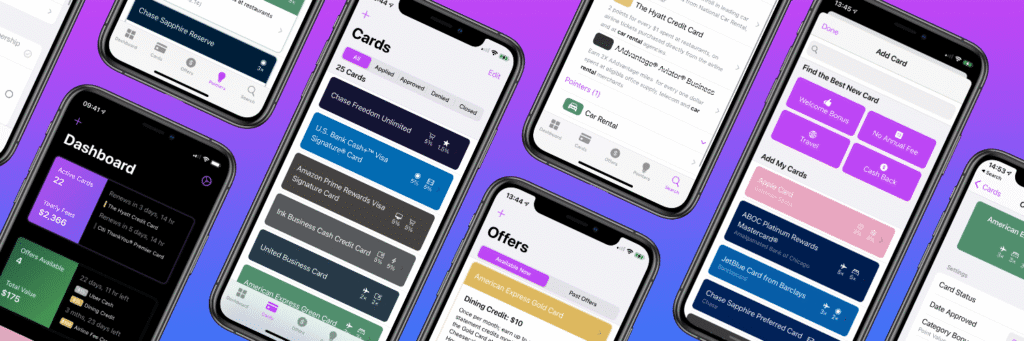

Keeping track of the best card to use for each purchase is usually a headache—especially if you have multiple Amex, Chase, Citi, or Bank of America cards, all with their unique categories and bonus offers. Enter Emmanuel, the founder of CardPointers, he launched CardPointers in 2019 as a web app, driven by the simple goal of helping users pick the best card in their real-life wallet for each purchase, without having to share sensitive bank login data. Since then, CardPointers has grown to support over 5,000 cards from more than 900 banks and credit unions across the US, Canada, and beyond. The app provides instant, category-based guidance—grocery, dining, gas, travel, shopping—and factors in all those rotating categories, bonus offers, annual credits, and fees.

Main Features: More Than Just Picking the Right Card

Here’s what stands out most about CardPointers and what you can do with it:

- Simple Card Tracking: Just add the names of your cards. No passwords or bank logins are needed. The app recognizes all your card benefits, fees, credits, and rewards.

- Automatic Offer Tracking: Auto-add Amex, Chase, Citi, Wells Fargo, US Bank, and Bank of America offers with a browser extension, saving you hours each month.

- Maximize Amex Offers Automatically: With one click, the extension can add every eligible offer to every card—including adding the same offer across multiple Amex cards, a trick that’s tough to do manually.

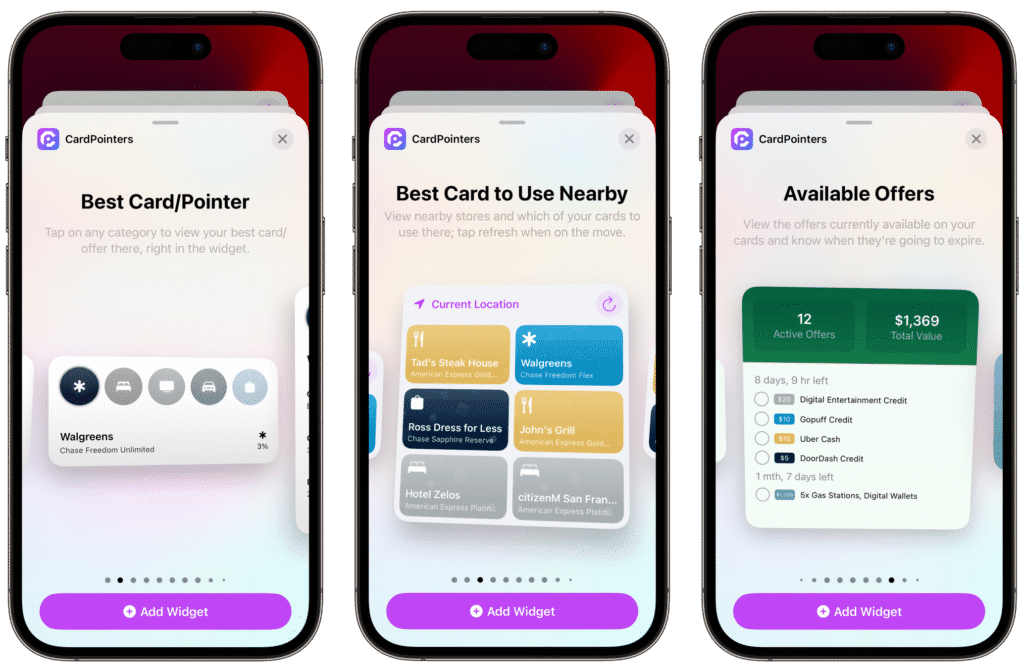

- Autopilot and Instant Recommendations: On iOS, Autopilot mode shows the best card to use right on your lock screen, powered by your current location. Walk into Safeway? Your phone can tell you: Use Amex Gold for 4x points on groceries.

- Browser Extension for Online Shopping: When you shop online, the extension recommends the best card and highlights any active offers or bonus points.

- Augmented Reality Mode: Point your phone at a store, and see a bubble pop up with the recommended card for that location—visual, fast, and cool.

- Family Account Management: Add up to six profiles—perfect for tracking Chase 5/24 status and renewal dates for all family members.

- Privacy First: Never asks for bank logins or card numbers—just card names—helping protect your security and peace of mind.

- Real-World Savings: On average, paid users report over $750 per year in value between cash back, statement credits, and extra points.

You can find CardPointers on iOS, Android, Mac, and as browser extensions for Chrome and Safari, with a Firefox version in the works.

How Does CardPointers Work in Everyday Spending?

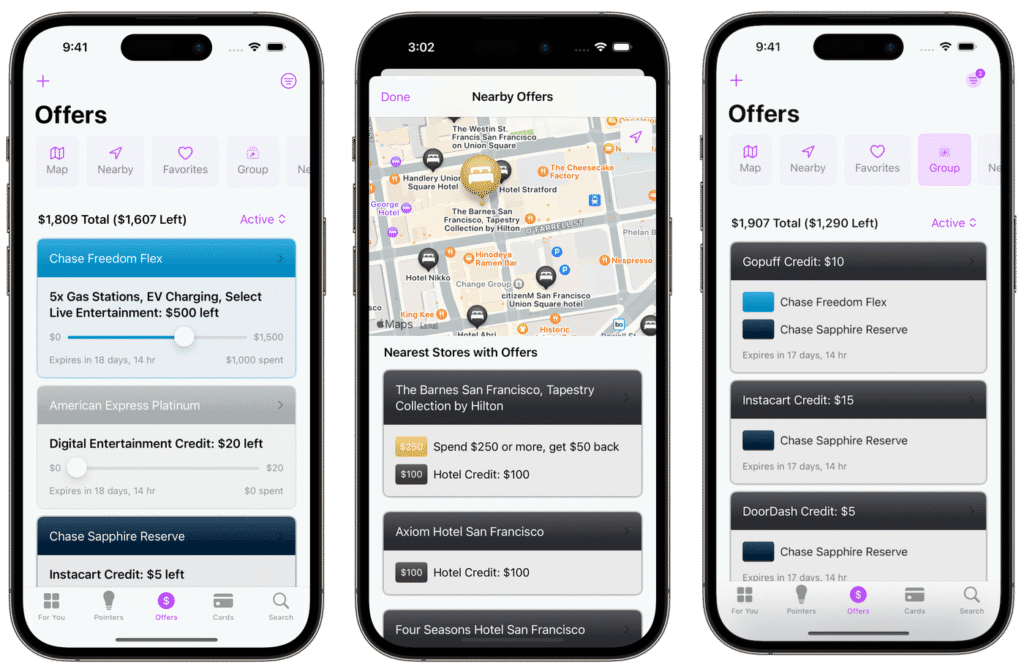

The strength of CardPointers is how little you have to think. For everyday purchases in store, just open the app and search for a merchant, or use the “nearby” feature to instantly see the best card to use at places closest to you. For online purchases, the browser extension does the heavy lifting. As you shop on a retailer’s site, the extension pops up to guide you—use this card for 5x points, or save $50 on a $200 spend, and so on.

CardPointers even integrates with Apple’s live activities. The Autopilot feature on iPhone and Apple Watch will show a notification on your screen as you move from store to store. Just glance at your phone or watch for automatic, location-aware guidance on which card to use.

Want to take it a step further? You can build shortcuts to start Autopilot automatically when you leave home, so you never miss out on bonus points or special offers.

Android support is improving, too. While some iOS features like live activities aren’t fully available yet on Android, Emmanuel expects Google to expand notifications in coming updates.

Maximizing Amex, Chase, and Citi Offers Without the Headache

One of the most painful tasks for points and miles fans is manually adding every new Amex or Chase offer, especially across several cards. CardPointers eliminates that.

With the Pro plan and browser extension, you can:

- Instantly auto-add hundreds of Amex or Chase offers with one click across multiple cards, including adding the same deal to all eligible cards.

- Sync offers directly within the app, so you never miss a cash back or statement credit—no more scrolling and clicking for hours each week.

This is a massive game changer for anyone who wants to maximize Amex or other Card issuer’s offers automatically. If you run a business or have several cards for different purposes, CardPointers will clearly show which card has which offer, and when each one expires.

If you’re managing credit card rewards for payroll, business purchases, or group spending, CardPointers can help you juggle multiple cards and logins without confusion. The app makes it easy to rename cards, add last four digits, and keep business and personal offers separate.

Looking for more tools to help make managing your rewards simple? Check out these best points and miles tools, including CardPointers and more.

Going Beyond Points: Keeping Up with Shopping Portals and Stacking Rewards

CardPointers encourages you to stack your rewards even further:

- Use the app together with shopping portals (like Rakuten or airline shopping portals) to multiply your points.

- Combine bonus category points, card offers, and portal cash back in a single transaction.

- Future updates will integrate even more shopping portal opportunities, making it even simpler to triple-stack your rewards.

For tips on getting the most value from portals, don’t miss this guide on how to use shopping portals to boost your points and miles. And if you want practical tips or help redeeming points, the BoldlyGo free points and miles consultation service can help with card recommendations, award bookings, and maximizing redemptions.

Free vs Pro: Which Plan is Right for You?

The free version covers all the basics:

- Track your cards by name (no sensitive info required)

- Search which card is best for a merchant or category

- Manually add single offers to cards

CardPointers Plus (Pro version) unlocks powerful automations:

- One-click auto-add of all offers across all eligible cards

- Autopilot recommendations on your lock screen and watch

- Augmented Reality mode

- Tracking across business and personal cards

- Family profile management

- Detailed renewal and annual fee tracking

- Chase 5/24 monitoring

- Support for more advanced features and deeper integrations

At $72 per year (or $50with the BOLDLYGO discount code), Pro pays for itself quickly. The lifetime Pro license drops from $240 to just $168 with the same code. Paid users rack up an average of $750+ per year in savings, not including the value of extra points and flights you might book.

Security and Privacy: No Bank Logins Needed

A major plus with CardPointers is its approach to privacy. Many other credit card rewards tools ask for your actual bank login credentials or sensitive account info—which creates real risks. CardPointers never asks for your banking password, card numbers, or financial details. The only info needed is the card’s name. Everything else happens on device or anonymously. If a data breach happened, your sensitive details wouldn’t be at risk—by design.

This approach keeps you safer than other tools, while still making it seamless to get real savings and maximize rewards.

Conclusion: Is CardPointers Worth It?

If you use multiple credit cards and care at all about points, miles, or maximizing your Amex/Chase/Citi rewards, CardPointers is a must-try. It’s the best credit card rewards app for anyone who wants to boost their travel, save money, and stop leaving free rewards on the table. There’s no need to juggle spreadsheets, memorize bonus categories, or fear you’ll miss a deal. With privacy built in, CardPointers stands apart from the crowd.

Ready to save your sanity (and your marriage, if your “player two” keeps using the wrong card)? Download the app or visit CardPointers.com/boldlygo to lock in your exclusive discount and start turning everyday spending into extraordinary travel.

Want more ways to travel smart? Don’t miss our guide on the best points and miles tools to round out your loyalty toolkit.

Let CardPointers help you take control of your wallet and your next adventure—so you can focus on enjoying the trip instead of worrying about the points.

Got questions or want personalized points help? Book a free points and miles consultation with the BoldlyGo team!